The following is an excerpt from “The Definitive Guide to Candidate Reimbursements” an eBook published by Reimbi in May 2020. Curious about how companies reimburse candidates for mileage expenses? What should your policy include? Read along to find out!

In some cases it may be more convenient and cost effective to have a candidate drive their personal vehicle rather than renting a car, flying, or taking other modes of transportation. It is typical, in the United States, to use the current IRS mileage rate (https://www.irs.gov/tax-professionals/standard-mileage-rates) as the amount you will reimburse candidates for each mile driven. This rate is inclusive, so candidates should not be reimbursed for mileage and for gasoline.

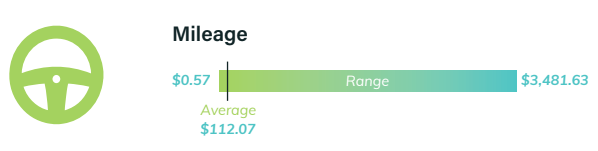

It is suggested to put lower and upper limits in place to avoid needing to process reimbursement for very short trips or to pay out excessive reimbursements for mileage when another mode of transportation should have been used.

Here is text to modify for your company’s policy:

Mileage when driving your personal vehicle to the interview is reimbursable if the one-way distance between your residence and the interview location is greater than 25 miles but less than 175 miles. You will be reimbursed using the current IRS mileage rate. When claiming mileage reimbursement do not include costs for gasoline or any other driving expenses.The full eBook with information on meal reimbursements, how and when to collect receipts, and much more is available via this link.